VNTR Newsletter April 27: Tariffs Hit the Venture Stack, Fintech Reinvents for AI

Venture Capital, Web3, and Private Equity – News, Events, and VC Reads

Happy Sunday!

Delivered weekly to 100k+ investors and subscribers, the VNTR Newsletter is powered by VNTR—the Leading Global Investor Community and Syndicate.

Tariffs And The Venture Value Chain: A Blip Or Long-Term Pain?

Tariff uncertainty is impacting the entire venture capital value chain. One report calls it the “biggest changes to the world trading system since the General Agreement on Tariffs and Trade came into effect in 1947.” A wave of tariffs and trade restrictions is reshaping alliances and redrawing global commerce. As governments rethink partnerships, startups must face a new reality. Geopolitics was once background noise for startups. Let’s explore the value chain — VC fundraising, startup fundraising and exits — to see how tariffs are driving both direct and indirect impacts.

Tariff-induced volatility is pushing even more growth-stage startups to venture debt

The venture debt industry isn’t sweating the fallout from President Donald Trump’s global trade war—in fact, some say it’s been good for business. Tariff-induced market volatility is driving more growth-stage startups to venture debt financing, lenders say, as companies that were already liquidity-starved see their IPO hopes sidelined. And ongoing uncertainty, some lenders say, is only going to fuel more debt activity. “This is the best time I’ve seen for venture debt opportunities,” said Mark Solovy, the head of venture debt at Monroe Capital. Since the start of the year, he said, interest in debt financing has gradually increased, and he’s seen it explode in recent weeks.

Fintech Isn’t Just Back, It’s Being Rearchitected For AI

In tech circles, we’ve been hearing it a lot: “fintech is back.” But for early-stage founders, it doesn’t always feel that way. In categories such as consumer and business banking, spend management or payments, the room is already crowded. Companies including Chime , Ramp, Mercury and Stripe dominate the news cycle and have become the perceived winners, soaking up capital and customer mindshare. But under the surface, something deeper is happening.

VC investment in India dips to $2.4 billion as investors fret amid global uncertainties

Venture Capital (VC) investment in India declined to USD 2.4 billion in January-March 2025 from USD 2.6 billion in the preceding quarter as investors remained wary amid the current geopolitical situation, according to a report by KPMG. Looking ahead, the report said that VC investment in India could remain "somewhat soft" in the second quarter of 2025 although the long-term outlook remains positive given the country's strong macros.

European financial services see surge in PE investment

PE deal value for Europe’s financial services sector grew more than 20% year-on-year in Q1, with the past 12 months seeing a surge of investment in the industry. In the first three months of 2025, €7.8 billion (around $8.4 billion) was invested in financial services in Europe, compared to €6.4 billion during the same period a year ago. However, this was across just 101 deals—the lowest deal count since Q3 2021.

Few Bright Spots In Asia’s Slowing Venture Market

Asia’s venture market continues to decline at an alarming rate, and it’s not just China weighing it down. Four of the top six venture markets in the region saw declines. Along with China, India, Singapore and Japan all sank lower. Only Israel and Japan saw upticks as the region continues to battle economic fluctuations, conflicts, geopolitical tensions and a possible trade war. Let’s take a look at exactly what’s happening in the region as we break down some of its biggest venture markets by country.

Resilience’ is the new VC buzzword. But what does it actually mean

European VCs are framing everything from defense to deeptech as “resilience.” The term is now central to emerging investment theses.

With Trade War Brewing, Can Canada Venture Build Off Strong 2024?

Tensions with the U.S. threaten Canada's VC rebound. After a strong 2024, investors now face new uncertainty from tariffs.

Why all US crossover funds are averaging just 170 VC deals a quarter

Crossover funds have pulled back as valuations stay high and exits remain scarce. Activity is down sharply from the 2021 peak.

The sentiment engine of Bitcoin ETFs is rewiring market structure

Capital is shifting from direct Bitcoin exposure to structured products like ETFs. This trend is changing how institutional capital interacts with crypto.

Mubadala’s new $1B push in private credit leverages its Fortress bet

Mubadala is doubling down on private credit through a $1B partnership with Fortress. The strategy targets asset-based lending and real estate.

Crypto startups no longer welcome in Nvidia’s accelerator program

Nvidia’s accelerator program has excluded crypto startups, adding them to its list of ineligible business types.

How Startups Can Conduct Layoffs Responsibly While Avoiding Costly Mistakes

Poorly handled layoffs can lead to legal and reputational fallout. Startups must follow employment law basics to avoid costly mistakes.

How Your Startup Can Take Advantage Of The R&D Tax Credit

The R&D tax credit helps offset innovation costs. Founders should understand how recent IRS rule changes under Section 174 affect eligibility and deductions.

Surviving The Scale: The Lessons I Learned From Growing A Unicorn

Scaling brings a new wave of challenges many founders underestimate. Growth is one of the top concerns for post-Series A startups.

The most active VCs and CVCs in Europe in Q1

Q1 2025 saw a rise in European startup funding. 165 VC and CVC funds backed over 1,000 startups in the quarter.

The 10 most active corporate investors in Europe in 2024

Top CVCs like BNP Paribas and Novo Holdings led 2024’s European corporate venture deals, with each backing 9+ startups across sectors like AI and climate.

Thank you to our Partners

A venture-style fund that expands the open-source Stellar Network. At the Stellar Development Fund, investment in companies can transform the future of everyday financial services through Web3 Innovation. Connect with Daniel to partner with Stellar.

Companies who would like to sponsor VNTR events can apply as a sponsor. View the top events sponsorship packages.

Or be a core supporter of the VNTR community year-round, engaging with our global investor network. Check Details & Packages.

Upcoming VC Events and Conferences

April 27-30 Web Summit Rio, Brazil

April 27 Guftagu's Hi Impact Circle, Gurugram, India (50% discount using code VNTR)

April 29 Tokenized Capital Summit 2025, Dubai, UAE (Complimentary VIP Tickets using code VNTR)

April 29-30 Startup Grind Conference, Silicon Valley, USA (Complimentary Investor Passes for VNTR)

April 30 - May 1 Token2049, Dubai, UAE

May 2 /function1 AI Conference, Dubai, UAE (Complimentary investor passes using code WELCOMEVNTR)

May 8-16 Vienna UP, Austria

May 8-9 SIM 2025, Porto, Portugal (complimentary passes by request irina@vntr.vc)

May 8-10 RiseUp Summit, Cairo, Egypt (25% discount using code VNTRXRISEUP)

May 9-10 Blockchain Week Rome, Italy (complimentary investor passes for Club members, 10% discount using VNTR10)

May 11-12 InsureTech Mena, Doha, Qatar (complimentary investor passes for VNTR using code VNTR25)

May 12-13 Dubai FinTech Summit, Dubai, UAE

May 14-16 Consensus, Toronto, Canada (20% discount using code VNTR20)

May 16 AI Rush, London, UK (complimentary investor passes for VNTR using code VNTRAIRUSH)

May 19-21 Penang Slush'D 2025, Malaysia (15% discount using code VNTRSLUSHD)

May 20-22 Qatar Economic Forum, Doha, Qatar

May 21-23 GITEX Europe, Berlin, Germany (Complimentary investor passes)

May 21-22 Upstream Startup Festival, Rotterdam, Netherlands (15% discount using code VNTR)

May 27-29 Bitcoin 2025, Las Vegas, US (25% discount using code VNTR)

May 27-30 Web Summit Vancouver, Canada

May 28-29 WOW Summit, Hong Kong

June 2-4 SuperVenture, Berlin, Germany (10% discount using code FKR3595VNTR)

June 2-8 New York Tech Week, USA

June 4-6 South Summit Madrid 2025, Spain (20% discount using code VNTRXSS20)

June 9-13 London Tech Week, London, UK (15% discount using code VNTR15)

June 11-14 Viva Technology, Paris, France (20% discount using code VNTR20)

June 19-21 BTC Prague, Czech Republic

June 25-26 FinTech Summit Africa 2025, Johannesburg, South Africa

June 26-27 LegalTech Talk, London, UK (Complimentary investor passes)

June 26-27 Istanbul Blockchain Week (10% discount using code VNTRIFW25)

June 30-July 3 Ethereum Community Conference, Cannes, France

July 8-9 RAISE Summit, Paris, France

July 17-18 India-Africa Entrepreneurship & Investment Summit 2025, Nairobi, Kenya

September 29 - October 2 CC Forum Zurich, Switzerland

If you would like to submit VC-related events, please send them to support@vntr.vc.

VNTR Events

Join us at our upcoming events to connect with key investment decision-makers:

April 28 2025

Investor Roundtable Silicon Valley

during Startup Grind Conference

April 29 2025

Club Mastermind Dubai

for active VNTR Club members only

April 30 2025

Investor Roundtable Madrid

May 1 2025

Investor Forum Dubai

during Token2049 Dubai

May 2 2025

Investor Roundtable Mumbai

May 6 2025

Investor Roundtable Miami

May 6 2025

Club Mastermind Lisbon

for active VNTR Club members only

May 7 2025

Investor Roundtable Istanbul

during Istanbul Fintech Week 2025

May 8 2025

Investment Committee Online

May 9 2025

Investor Roundtable Porto

during SIM 2025

May 9 2025

Investor Roundtable Cairo

during RiseUp AI Summit Egypt

May 12 2025

Investor Roundtable Doha

during MENA InsurTech Summit 2025

May 13 2025

Investor Roundtable Dubai

during Dubai Fintech Summit

May 14 2025

Investor Roundtable Vienna

during Vienna UP

May 15 2025

Club Mastermind Online

for active VNTR Club members only

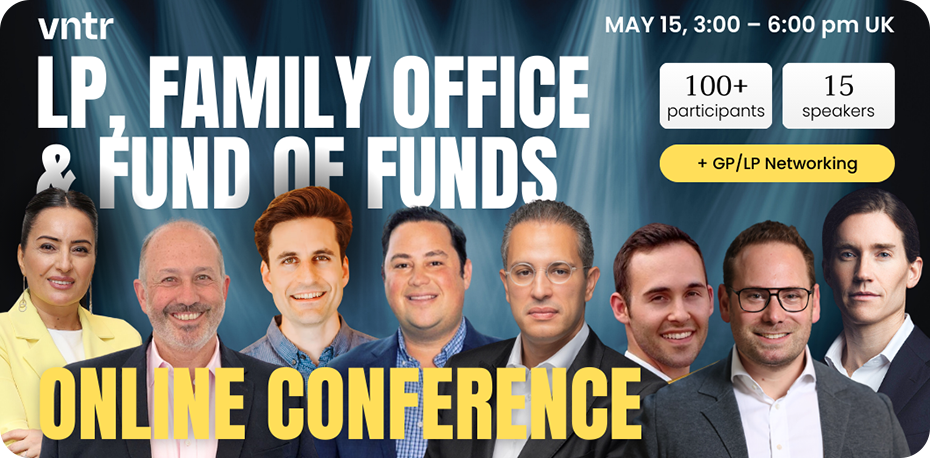

May 15 2025

Investor Forum Toronto

during Consensus

May 15 2025

LPs, Family Offices & Fund of Funds Online Conference

May 16 2025

Investor Breakfast San Diego

May 21 2025

Investor Roundtable Rotterdam

during Upstream Festival

May 21 2025

Investor Roundtable Doha

during Qatar Economic Forum

May 21 2025

Investor Roundtable Penang

during Penang Slush'd

May 22 2025

Investor Roundtable Berlin

during GITEX Europe