VNTR Newsletter Jan 19, 2025 - GCC Roadshow

Venture Capital, Web3, and Private Equity – News, Events, and VC Reads

Hello friends,

Happy Sunday!

VNTR Newsletter is delivered to 100k+ investors and subscribers weekly to share the latest news, events, and articles from the global VC and startup ecosystem.

Scroll down to discover VNTR Community News, Upcoming Events, and the latest VC News and Reads.

VNTR COMMUNITY NEWS

Spotlight

New Partner Announcement: ATME joined as a partner for the VNTR Investor Conference Bahrain. Bahrain-licensed digital assets platform is rapidly establishing itself as a transformative force in the capital markets. ATME bridges traditional finance principles with digital innovation opportunities, providing a secure and compliant exchange for tokenized assets (Real-World Assets, RWAs). Contact Julia to learn more.

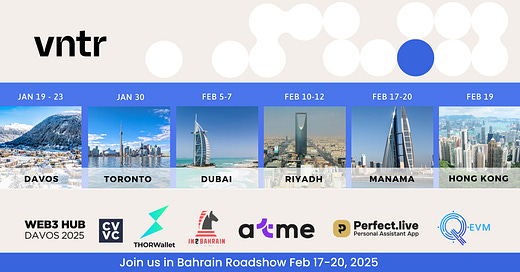

VNTR at Davos WEF 2025: Join us in Davos during the World Economic Forum for an exclusive series of high-impact events:

Jan 19 VENTURE Club Ski Retreat supported by Yalla Limited and Denario

Jan 22 VENTURE Investor Roundtable (sponsorship packages) supported THORWallet, CV VC, CV Labs, Web3 House Davos, Car Vision

Jan 23 VENTURE LP Roundtable (GPs interested in presenting, contact Yuri) supported by UnDavos

VNTR Roadshow Bahrain: Join us for a 4-day VNTR Roadshow Bahrain and the VNTR Investor Conference Bahrain on February 18, supported by In2 Bahrain and ATME. We invite companies interested in the Bahrain market to join as partners (sponsorship packages). Apply to join the Roadshow

New Partner Offers:

Digital Assets Forum, London - (15% discount using 15VNTR, complimentary for VNTR Club members)

VNTR GP Club Membership: We invite seasoned General Partners (GPs) raising their third or subsequent funds to join the VNTR GP Club Membership and connect with potential global LPs through the VNTR platform, LP-focused events, and curated member introduction service. Schedule an onboarding call with Robert.

Corporate Partners: Partner with us to elevate your brand, expand your reach, and be part of a thriving global investor community. You can sponsor a series of events or join our Annual Corporate Partnership program for year-round engagement. Contact Sara to explore customized corporate integration opportunities.

VNTR Podcast: Stay updated with our latest episodes, and subscribe on your preferred platform to never miss insightful discussions: YouTube, Spotify, and Apple. Contact Elise if you would like to be on the show.

VNTR Events

Join us at our upcoming events to connect with key investment decision-makers:

Jan 30 VNTR Investor Breakfast Toronto supported by Highline Beta

Feb 5 VNTR Investor Roundtable Dubai (sponsorship packages) during AI Everything (complimentary investor passes)

Feb 10 VNTR Investor Roundtable (sponsorship packages) during LEAP (complimentary investor passes)

Feb 11 VNTR LP Roundtable during LEAP

Feb 14 VNTR Investor Roundtable Hokkaido, Japan during Hokkaido Innovation Week

Feb 18 VNTR Investor Conference Bahrain (sponsorship packages)

Feb 19 VNTR Investor Roundtable Hong Kong (sponsorship packages) during Consensus Hong Kong supported by QuantumEVM

Feb 24 VNTR Investor Roundtable Doha (sponsorship packages) during Web Summit Qatar

Feb 27 VNTR Investor Roundtable Denver (sponsorship packages) during ETHDenver

March 5 VNTR Investor Roundtable Barcelona during Mobile World Congress

View the full list of VNTR events and top events sponsorship packages

Follow us on Social media: Instagram, LinkedIn, Facebook, Flickr, and X.

Thank you to our Partners:

THORWallet — DeFi Bank in your Pocket 🔒 The ultimate DeFi wallet on iOS and Android, including multi-signature functionality for retail users whales, treasuries, and DAOs. Thorwallet enables seamless trading & savings with zero intermediaries. It is a fast-growing and profitable platform generating $950m yearly trading volume. Contact Marcel Harmann, Founder and CEO

Perfect — Your Personal Lifestyle app that helps you Book flights and hotels and manage your lifestyle. Enjoy personalized assistance with tasks, errands, and reservations, freeing time for what truly matters. Join Perfect using "VNTR" code to get special discounts and access to VNTR experiences.

UPCOMING VC EVENTS

Jan 20-24 World Economic Forum, Davos, Switzerland

Feb 3 Digital Assets Forum, London (15% discount using 15VNTR)

Feb 4-6 AI Everything Global, Dubai, UAE (complimentary investor passes)

Feb 5-7 Techchill, Riga, Latvia

Feb 9-12 LEAP, Riyadh, Saudi Arabia (complimentary investor passes)

Feb 18-20 Consensus, Hong Kong

Feb 23-26 Web Summit Qatar, Doha, Qatar

March 3-6 4YFN, Barcelona, Spain

March 3-6 Mobile World Congress

March 25-26 CEE VC Summit, Warsaw, Poland

April 9-11 South Summit Brazil, Porto Alegre, Brazil

April 14-16 GITEX Africa, Marrakech, Morocco

April 23-25 GITEX Asia, Singapore

April 27-30 Web Summit Rio, Brazil

April 30 - May 1 Token2049, Dubai, UAE

May 12-13 Dubai FinTech Summit, Dubai, UAE

May 14-16 Consensus, Toronto, Canada

May 21-23 GITEX Europe, Berlin, Germany

May 27-30 Web Summit Vancouver, Canada

June 11-14 Viva Technology, Paris, France

If you would like to submit VC-related events, please get in touch with Yuri or Telegram @byuric

VC Reads and News

View curated VC news and articles on the VNTR Platform

Led By A16Z, Active Investors Upped Their Game In 2024

Thanks to venture capitalists’ appetite for artificial intelligence deals, startups saw a measurable pickup in funding last year. But not all investors participated equally in the gains.

A handful of mostly cross-stage firms led both the largest number of rounds and the most valuable ones, Crunchbase data shows. For those who follow startup funding, they are mostly familiar names.

Topping or nearly topping the list by multiple metrics was Andreessen Horowitz, also known as a16z. The Silicon Valley firm, a U.S.-centric investor, has long been known for both the high number of deals it backs and the large sums it spends.

The Week’s Biggest Funding Rounds: Biotech And Space Tech Bring In The Money

This is a weekly feature that runs down the week’s top 10 announced funding rounds in the U.S. Check out the biggest funding rounds of last week here.

Thus far 2025 has come roaring in as far as large rounds go. Last week more than a dozen companies raised $100 million or more. This week there are fewer, but not by many, as companies needed to raise at least $100 million to make this list.

PE exits revive after 2-year lull

After over two years of stagnation, exit activity for the US private equity market is finally embracing its long-desired recovery.

The overall value of US PE exits hit $413.2 billion in 2024, a nearly 50% leap from the previous year, according to PitchBook’s latest US PE Breakdown.

The total number of deals also showed encouraging growth, reaching 1,501 last year, up 16.6% year-over-year.

Crunchbase Unicorn Board Tops $1T In Funding Raised

Last month, the companies on The Crunchbase Unicorn Board topped $1 trillion in collective funding for the first time, marking a new milestone for the board, which lists private, venture-backed companies around the globe that have hit billion-dollar valuations. The board counted a total of 1,562 unicorns at year-end, not including companies that have exited or shuttered after joining.

In 2024, a total of 109 companies joined our unicorn board, adding close to $250 billion in value and $53 billion in funding. Contrast that with 2023, when 100 companies joined and added close to $145 billion in value.

Despite VCs investing $75B in Q4, it’s still hard for startups to raise money, data proves

After two years of relatively muted investment activity, it seems that VCs are starting to pour capital into startups at pandemic-era levels once again. But a closer look shows that they aren’t really.

In the fourth quarter of last year, investors funneled $74.6 billion into U.S. startups, a substantial increase from the average of $42 billion invested in each of the previous nine quarters, according to PitchBook data released on Tuesday.

46% of crypto VC funds went to US startups in Q4, and Trump could boost that

About half of all venture capital funding in the fourth quarter of 2024 went to cryptocurrency startups headquartered in the United States, and an incoming pro-crypto administration could push that further.

Galaxy Digital’s Crypto and Blockchain Venture Capital report, filed on Jan. 15, found that 46% of capital invested went to startups headquartered in the US, dwarfing the jurisdiction in second place, Hong Kong, which captured 16%.

The US also led the deal count, with 36% of all venture capital (VC) deals involving a company in the US, followed by Singapore with 9% and the UK with 8%.

The number of active VCs in Europe has dropped by 30% in the last two years

The number of active VCs in Europe has dropped off from its peak in 2022, as exits slow, LPs wait for liquidity and startups have sought profitability over growth at all costs.

The count of European VCs involved in at least one deal in Europe per year has dropped about 30% from 5,704 in 2022 to 4,044 in 2024, according to data from PitchBook provided to Sifted.

Big Rounds Push Cybersecurity Comeback

Cybersecurity venture investment jumped 43% in 2024 from the previous year as big rounds came back strong. That was despite flat funding quarter to quarter in Q4 and a smaller number of deals during the year.

Total funding to VC-backed cybersecurity startups hit nearly $11.6 billion last year, per Crunchbase data. That tops the $8.1 billion raised by startups in 2023, though remained well under the $17 billion invested in 2022.

Climate-tech VC deals fell for 3rd straight year

The total amount of VC funding for climate-tech startups fell more than 17% year-over-year in 2024, marking the third annual decline in a row—a signal that AI is continuing to siphon venture dollars away from other sectors.

Climate-tech startups raised $24 billion in 2024 across 1,314 total VC deals in North America and Europe, according to the Q4 2024 PitchBook-NVCA Venture Monitor. That’s well off 2021’s peak of $41 billion across 1,984 total deals.

Like Bananas, Most Unicorn Startups Peak When Underripe

Like most people who regularly add bananas to the grocery cart, I’ve become something of an expert on their lifecycle.

Not until today, however, did I consider the parallels between this ubiquitous fruit and the typical startup.

The core similarity is this: The banana — much like a startup — peaks when slightly underripe.

Europe’s Startup Funding Stabilized In 2024, But Remains Far Off Market Peak

Funding to Europe-based startups settled year over year in 2024. Funding reached $51 billion, down by 5% year over year from $54 billion invested in 2023, Crunchbase data shows.

Europe’s startups raised 16% of total global venture capital in 2024, down slightly from 18% in the prior two years. (Although it’s good to keep in mind that some European startups move their headquarters to the U.S. but retain large teams in Europe, which skews the funding numbers in favor of the U.S., with funding counts based on where a company is based.)

The unicorns that could be due a fundraise in 2025

2024 saw growth-stage funding in Europe fall for the third year in a row as the VC market continued to settle into more frugal post-frothy days.

Startups in the region picked up $17.3bn in $100m+ rounds last year, according to Dealroom, way down from a record $61.6bn in 2021 but still higher than any year before then.

LPs weigh VC’s liquidity slump

Venture capital’s liquidity problem isn’t going away any time soon. For limited partners, this dynamic restricts their ability to both commit additional capital to the asset class and the types of funds they’ll be able to support in the new year and beyond.

VC fund distributions have been on a steady decline for the past three years, as return-generating exits dwindled. For context, there were only 40 exits valued at $500 million or more in 2024, compared to 220 in 2021, according to the Q4 2024 PitchBook-NVCA Venture Monitor.

Female founders just took in their smallest share of VC deals in five years

Fei-Fei Li, the ex-director of Stanford’s AI lab often called the “godmother of AI,” had VCs clamoring to invest in her startup last year.

In just four months, Li built her startup World Labs into a unicorn backed by NEA and Andreessen Horowitz.

Around the same time, OpenAI‘s CTO Mira Murati quit. Murati’s departure from OpenAI set her up as one of the most sought-after new founders of the AI age.

What Should Startups Look For From VCs After Investment?

You’re a first-time founder who’s just raised an early-stage round with key investors on board. Now, how can you make the most of your cap table?

Venture capitalists often talk about “adding value” to their firms’ portfolio companies, but it can be difficult for entrepreneurs to understand what that means in practice.

European life sciences kicks off year with deluge of VC capital

Europe’s life sciences sector has seen a strong start to the year for venture capital investments, as a handful of mega-rounds has already pushed Q1 deal value past the last quarter’s halfway mark.

In less than a month, €1.2 billion has been invested in European life sciences startups, according to PitchBook data. This represents 55.7% of total deal value in the region this year and over a third of the capital invested in life sciences globally.

Cutting Through The Funding Frenzy: How To Hook Reporters With Your Story

Newsrooms are shrinking, and reporters are increasingly pressed for time to write compelling and differentiated stories about the state of venture capital. As a result, startup funding announcement coverage is typically reserved for the biggest numbers or the most well-known VC backers. Ensuring your startup’s funding news stands out requires a concise narrative, a connection to larger industry trends, and a clear articulation of how your company is uniquely positioned to drive change. Here are some common missteps to avoid and tips to ensure your funding news doesn’t go unnoticed.

Crypto projects need more visionary funding for long-term growth

The euphoria that erupted in crypto markets following the outcome of the US presidential race solidified Bitcoin’s status as a mature asset class in the eyes of the global investor community. The recent market backdrop unleashed arguably the most potent crypto bull run in its 16-year history, pushing the price of Bitcoin past the $100,000 barrier.

The fervent activity of institutional investors further propelled Bitcoin’s recent price rally. While most in Web3 welcome the inflow of institutional money into crypto, the level at which these investors will drive innovations forward and support true breakthroughs in Web3 technology is questionable.

Climate tech matured in 2024 as investors favored bigger rounds, later stages

Climate tech may have had a down year in 2024, but new data also shows a maturing sector with larger deal sizes.

Venture investment in the climate tech sector was down 7% to $12.9 billion, $1 billion shy of 2023’s tally, according to data in a new PitchBook report. The report found that round size increased in 2024 and investors appeared more eager to back companies that had emerged from their seed round.